The Relentless Ascent: Understanding the Drivers of Tuition Hikes

College costs have risen dramatically for decades due to several factors:

- State Disinvestment: Public colleges historically relied on state funding. However, state appropriations have significantly decreased, especially after economic downturns. This forced institutions to raise tuition fees to compensate for lost revenue, shifting the financial burden to students.

- Administrative Growth: Universities have seen a notable increase in non-teaching administrative staff and their associated costs. This “administrative bloat” contributes to rising expenses passed on to students through higher tuition.

- Amenities Arms Race: To attract students, colleges often invest heavily in lavish facilities like recreation centers and dining halls. These expensive “amenities” contribute significantly to the overall cost of attendance, driving up tuition.

- Federal Aid’s Role (Bennett Hypothesis): Some argue that increased federal student aid allows colleges to raise prices, knowing students have access to more funds. This complex dynamic suggests federal aid, while helpful, might inadvertently fuel tuition increases.

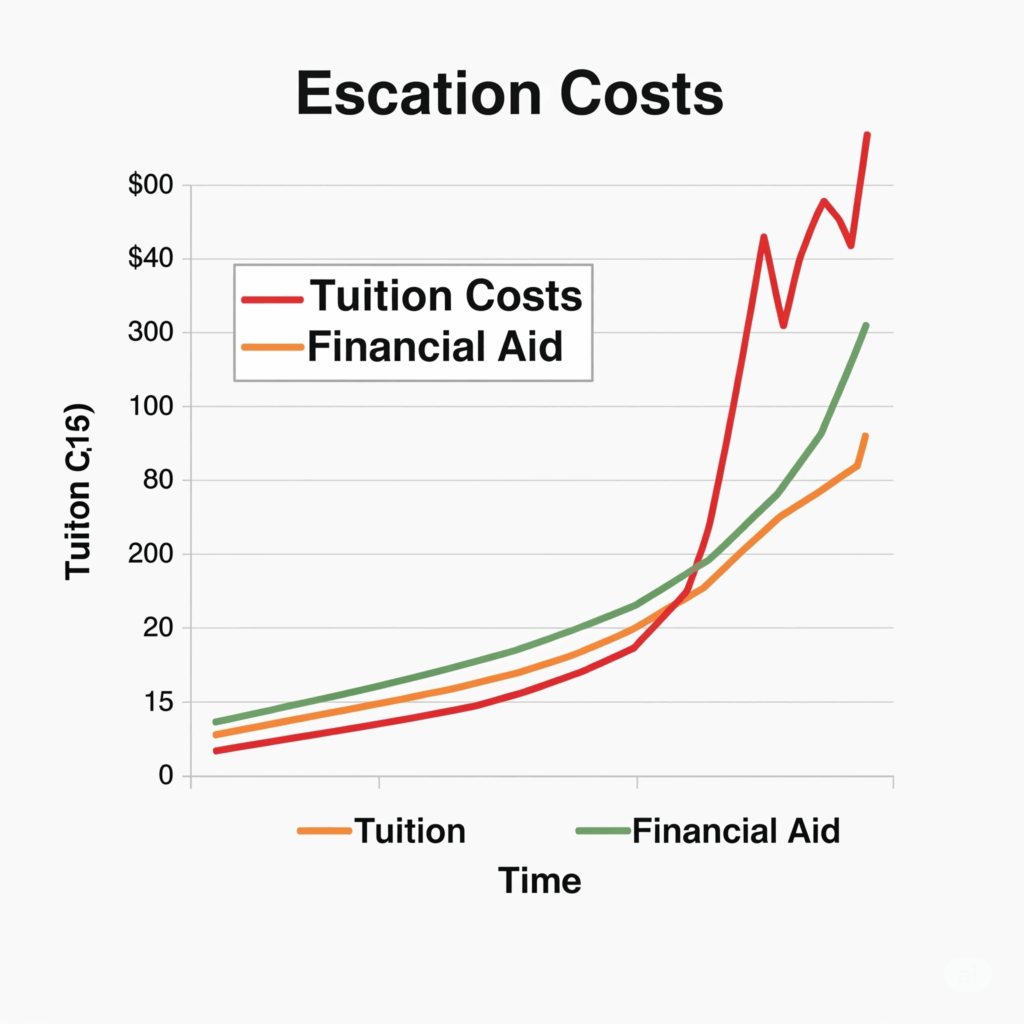

The Widening Chasm: Aid Gaps and Eroding Affordability

As college costs surge, financial aid struggles to keep pace, creating substantial gaps between a student’s need and the assistance they receive.

- Stagnant Grant Aid: While total financial aid has grown, much of it comes as loans, not grants. The Pell Grant, a vital federal need-based grant, now covers a much smaller percentage of college costs than it once did, forcing more reliance on borrowing.

- Rise of Merit-Based Aid: The increasing focus on merit-based scholarships, which often benefit wealthier students, can divert resources from those with the greatest financial need, further exacerbating inequality in access.

- Complex Aid System: The Free Application for Federal Student Aid (FAFSA) and the overall aid system are often complex, deterring eligible students and making it difficult for families to navigate their options.

The Weight of the Future: The Crushing Burden of Student Debt

The most direct consequence of high costs and aid gaps is the massive accumulation of student loan debt, impacting individuals and the economy.

- Staggering Scale: Total outstanding student loan debt in the U.S. now exceeds $1.7 trillion, making it the second-largest category of household debt after mortgages.

- Individual Impact: Borrowers often delay major life milestones like buying homes, starting families, or saving for retirement. Loan payments consume significant income, causing financial strain and psychological stress. Entrepreneurship can also be stifled.

- Economic Consequences: This debt can reduce consumer spending, hindering economic growth and job creation. High default rates also raise concerns about financial stability.

Charting a New Course: Towards College Affordability and Accessibility

Addressing this crisis requires a comprehensive approach:

- Reinvesting in Public Higher Education: States must increase funding to reduce reliance on tuition.

- Addressing Institutional Costs: Colleges need to scrutinize administrative spending, streamline operations, and prioritize academic value over lavish amenities.

- Strengthening Need-Based Financial Aid: Increase Pell Grant funding and ensure its purchasing power keeps pace with costs. Simplify aid applications and prioritize need-based over merit-based aid.

- Tackling the Student Debt Crisis: Implement targeted debt relief, improve income-driven repayment plans, and prevent future debt accumulation through tuition caps and responsible borrowing.

Conclusion: Reclaiming the Promise of Higher Education

America’s college cost conundrum threatens the dream of higher education for many. By reinvesting in education, controlling institutional spending, strengthening financial aid, and addressing student debt, the nation can ensure that college remains an accessible and empowering force, driving individual opportunity and a stronger, more equitable society. The time for decisive action is now.